Table of contents

Introduction to Parcl

Let's being with what exactly is Parcl and how can it help us. To start Parcl is a Platform that lets users trade Synthetic assets leveraging AMM (Automated market markers) now what exactly does this all mean? Let's take a deeper look at it.

Synthetic Assets

Synthetic assets are those that can't be owned physically such as a stock of a company that allows you to have a percentage share of the company however it lives on a sheet of paper that provides its value. Same way Parcl allows its users to purchase Real World assets such as the real-estate in a synthetic format.

Automated Market Markers(AMM)

Usually referred to as AMM, is highly used in popular DEFI protocols such as Uniswap and PancakeSwap. Automated Market marker, is a type of Decentralized exchange protocol that uses Mathematical Algorithms to determine the value of the asset based on lending and borrowing. Over here a liquidity pool is created that holds multiple assets and these pools are funded by a liquidity provider based on which the liquid providers gain incentives. If a trader wants the underlying asset in the pool it will provide an asset of its type that will have an Intrinsic value higher or lower than the underlying asset in the pool based on it the AMM provides the quantity of the asset that is held in the pool while keeping and managing the pool at a constant value that was defined at the time of pool creation.

Now that we have understood the basis of Parcl we will deep dive into its architecture.

To Understand Automated Market Marker https://www.youtube.com/watch?v=1PbZMudPP5E&ab_channel=WhiteboardCrypto The video is by WhiteBoard Crypto and it explains the above context in animated format.

Architecture of Parcl

Pool:- In Parcl, each pool is dedicated to a specific market, such as real-world assets. These pools can be further divided into smaller sub-pools that target specific components of that market or can encompass the entire market itself. Traders have the opportunity to make long and short calls on the asset.

A long call means the asset will rise.

A short call means the asset will fall.

The pool continues to receive funds from the liquidity providers that receive rewards based on providing liquidity. The reward received by the Liquidity provider is called trader liquidity tokens.

Each pool consists of 3 vaults that hold different tokens

Collateral: The stablecoin or underlying asset provided by liquidity providers.

Trader liquidity token: The reward liquidity providers receive for providing liquidity to the pool.

Protocol fees: The fees made by the protocol that is collected from the traders.

Accounting Model:- each pool has its own set of tokens when a trader opens a position they become an implicit Liquid provider, however on the time of closing the position they are paid via the liquidity token and not in their collateral usually the dollar the traders are also called explicit liquidity providers on the time of closing.

The exchange rate for adding or removing liquidity in the pool is determined by the ratio of the total collateral in the pool to the total supply of liquidity tokens. Based on this the payout of the tokens is given out. The tokens can then be swapped for direct dollars.

When the trader closes the position the exchange rate is affected, such that either the liquid token is burnt or more is minted.

Traders Profit and Lose: Traders deposit the collaterals in our case the USDC and the protocol mints liquidity tokens at the current exchange rate that are placed in the vault. This presents the trader's ownership of the amount he has deposited in the pool. If the trader makes a profit at the end of closing his position the protocol mints more tokens based on his earnings however, if the trader makes losses during the time of closing his position the token is burnt from the circulation.

After the position is closed, traders have the option to redeem any newly received liquidity tokens at the updated exchange rate. This allows them to immediately realize a gain or loss in collateral based on the PnL of their position.

For example, let's say a trader opens a position and receives 10 liquidity tokens at an exchange rate of 1 collateral per liquidity token. When closing the position, the trader earns a positive PnL, resulting in the protocol minting an additional 3 liquidity tokens. Now the trader holds 13 liquidity tokens. If the exchange rate has changed to 0.8 collateral per liquidity token, the trader can redeem their liquidity tokens and receive 10.4 collateral, reflecting an immediate gain in collateral due to the positive PnL.

However, if the trader's position incurs a negative PnL, let's say -5 liquidity tokens are burned, reducing their position to 8 liquidity tokens. If the exchange rate is still 0.8 collateral per liquidity token, the trader can redeem their remaining liquidity tokens and receive 6.4 collateral, representing a loss in collateral due to the negative PnL.

Skew Management: The protocol uses two mechanisms to manage skew and encourage balance in the open interest. These mechanisms are designed to provide incentives for traders to maintain a balanced distribution of long and short positions and discourage excessive skew.

Incentivizing Balance: The protocol offers incentives to encourage traders to balance the long and short open interest. By maintaining a balanced distribution, traders can benefit from improved execution when closing positions and reduce the risk of potential losses when redeeming liquidity tokens. The specifics of these incentives may vary depending on the protocol, but they generally aim to reward traders for contributing to a balanced pool.

Disincentivizing Imbalance: On the other hand, the protocol discourages excessive skew by implementing disincentives. This means that if a trader creates an imbalanced pool by taking a disproportionately large position in one direction, they may face certain penalties or disadvantages. These disincentives are put in place to mitigate the risks associated with asymmetric funding flows and potential losses resulting from liquidity token redemptions.

Overall, the goal of these mechanisms is to create a more stable and balanced trading environment, where all stakeholders in the pool can benefit. By aligning incentives and disincentives, the protocol aims to encourage responsible trading behavior and reduce the potential negative impacts of skew on liquidity and trader experiences.

To further understand the architecture and the payment model here is the link to the whitepaper. https://parcl.notion.site/Parcl-v2-6f27eaed8a5e46e29762a9de128ba0f9.

Advantages

Since it is automated traders don't need to depend upon a dealer or any middleman.

Buying or Real world assets for a fraction of the price

Risk-free investment for Liquidity providers as the price of one asset decrease cant affect the pool due to the balancing of AMM.

Key Features of Parcl

Isolated Pools: The platform operates with isolated markets called pools. Each pool has its own long-short skew and funding rate, allowing traders to gain exposure to specific price feeds, and liquidity providers (LPs) to provide liquidity to those pools.

Solvency: The exchange rate between a pool's collateral token (such as a stablecoin like USDC) and its liquidity token acts as a "bonding curve." This ensures solvency as trader performance and payouts are in liquidity tokens. Positions clear into collateral based on available resources in the pool, rather than following a dollar-for-dollar accounting model.

Price Execution: All positions are opened and closed at the current price provided by a pool's Oracle price feed. This mechanism helps maintain the price peg of positions, as they can only be traded using the core smart contract.

Zero Credit Risk: The platform does not provide borrowing on margin. Instead, traders can select leverage up to 10x to amplify price movements. The pool is compensated for this risk through long-short funding and skew impact fees.

Optional Liquidity Provision: Liquidity providers have the option to participate. Traders trade against each other, and the pool's exchange rate serves as a proxy for an insurance fund or liquidity backstop. LPs provide collateral in exchange for liquidity tokens, earning reinvested fees and taking on the other side of net trader profit and loss (PnL). Liquidity tokens can be redeemed for collateral at the current exchange rate.

Skew Management: The pool employs two mechanisms to manage open interest imbalances or "skew." These mechanisms are long-short funding and skew impact fees. Impact fees are applied only to positions that worsen the imbalance. Traders in balanced pools are less likely to encounter significant principal risk when redeeming liquidity tokens for collateral after closing positions.

Delayed Settlement: Collateral leaving the protocol undergoes a delayed settlement. This safeguard protects all stakeholders in the event of an emergency, as the protocol administrator can pause the protocol and mitigate risks associated with immediate withdrawals.

Benefits of Investing In Real Estate for Crypto Natives.

Portfolio Diversification: Real estate provides an opportunity to diversify investment portfolios beyond the cryptocurrency market. By allocating a portion of funds to real estate, crypto natives can reduce their exposure to the volatility and risks associated with crypto assets, potentially achieving a more balanced investment strategy.

Tangible Asset: Real estate investments offer the advantage of being tangible assets with inherent value. Unlike digital assets that solely exist in the virtual realm, owning physical properties provides a sense of security and stability. Real estate investments can serve as a hedge against inflation and provide long-term appreciation potential.

Income Generation: Real estate investments are constant income generators through rental payments. By acquiring properties and renting them out, crypto natives can create a passive income stream that can supplement or diversify their cryptocurrency earnings. This income can provide financial stability and enhance overall cash flow.

Potential for Capital Appreciation: Real estate has historically demonstrated the potential for capital appreciation over the long term. Investing in properties located in high-demand areas or emerging markets can lead to significant value appreciation, allowing crypto natives to build wealth over time.

Diversification of Investment Strategies: Real estate investments offer different strategies, such as buy-and-hold, fix-and-flip, or rental properties. Crypto natives can leverage their analytical and research skills to identify undervalued properties or emerging real estate markets, applying their investment expertise to real estate opportunities.

Opportunities for Tokenization: The emergence of blockchain technology has opened up opportunities for the tokenization of real estate assets. This allows crypto natives to invest in fractional ownership of properties, enabling them to diversify their real estate holdings and participate in high-value properties that may have been otherwise inaccessible.

Hedging Against Crypto Volatility: Cryptocurrencies are known for their price volatility. Investing in real estate can provide a stable and less volatile investment option, potentially serving as a hedge against the price fluctuations of crypto assets. This can help crypto natives mitigate risk and reduce exposure to a single asset class.

Benefits of Investing in Real Estate Indices:

Diversification: Real estate indices provide exposure to a diversified portfolio of properties across various geographic locations and property types. By investing in an index, investors can gain access to a broad range of real estate assets, which helps spread risk and reduce concentration in a single property or market.

Professional Management: Real estate indices are typically managed by professionals who have expertise in selecting and managing a diversified portfolio of properties. Investors can benefit from the knowledge and experience of these professionals without the need for active management on their part.

Liquidity: Investing in real estate indices offers greater liquidity compared to direct property ownership. Investors can buy and sell shares in the index on an exchange, providing a more liquid investment option. This allows investors to easily adjust their real estate exposure based on their investment objectives and market conditions.

Lower Barrier to Entry: Real estate indices generally have lower minimum investment requirements compared to purchasing individual properties. This makes it more accessible for investors with limited capital to gain exposure to the real estate market and benefit from potential returns.

Transparency and Accessibility: Real estate indices provide transparent pricing and performance information, allowing investors to track the performance of their investments in real-time. This transparency enhances investor confidence and facilitates informed decision-making.

Benefits of Fractional Ownership:

Access to High-Value Properties: Fractional ownership allows investors to participate in high-value properties that may be financially out of reach for individual investors. By pooling resources with other fractional owners, investors can collectively own a share of premium properties, such as luxury homes, commercial buildings, or resort properties.

Diversification within Real Estate: Fractional ownership enables investors to diversify their real estate holdings by investing in multiple properties across different locations and asset classes. This diversification can help mitigate risks associated with investing in a single property and provide exposure to a broader range of real estate opportunities.

Flexibility and Control: Fractional ownership offers investors greater flexibility and control over their investments compared to investing in real estate funds or indices. Investors can choose specific properties to invest in and have a say in the management and decision-making processes related to the property.

Potential for Rental Income: Fractional ownership allows investors to receive a proportional share of rental income generated by the property. This can provide a steady stream of income and potentially enhance the overall return on investment.

Potential for Capital Appreciation: Fractional owners can benefit from the potential appreciation in property values over time. If the property increases in value, the fractional owner can sell their share at a higher price, potentially realizing capital gains.

Competitive Landscape

Compound: Compound is one of the most well-known DeFi lending platforms, allowing users to lend and borrow various cryptocurrencies. It offers competitive interest rates and has a significant user base.

Aave: Aave is another prominent DeFi lending protocol that supports a wide range of cryptocurrencies and utilizes innovative features like flash loans. It has gained popularity for its user-friendly interface and robust security.

MakerDAO: MakerDAO is a decentralized lending platform that enables users to generate a stablecoin (DAI) by locking up collateral assets. It has been a pioneer in the DeFi space and has a significant market share in the lending sector.

Synthetix: While primarily focused on synthetic asset creation and trading, Synthetix also offers lending and borrowing functionalities within its platform. It allows users to collateralize their assets to mint synthetic tokens.

Yearn.finance: Yearn finance is an aggregator platform that optimizes yield farming strategies across various DeFi protocols. While not a direct lending/borrowing platform, it indirectly competes by offering users a way to maximize returns on their assets.

How to Trade on Parcl :

Navigate to Parcl and connect your Solana wallet. Once done the interface should look like this.

Click on the Add Funds option to Add USDC in order to trade

The minimum funds that can be added is 30 USD, it can either be directly brought on the platform or it can be deposited from the wallet

Once the Fund is deposited user can start trading.

Select any one market to being with

Click on the trade option

We Selected Chicago

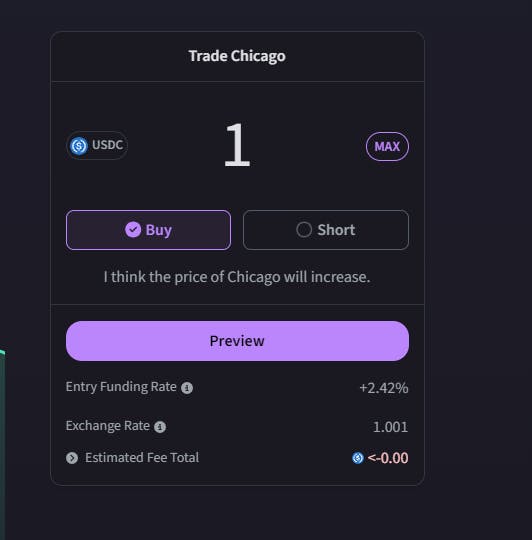

Add your preferred amount I am adding 1 $

Then Select either to Buy it or to Short it. Buy indicates that the price of the Chicago-based properties will go up , and Short indicates the price of the Chicago properties will go down.

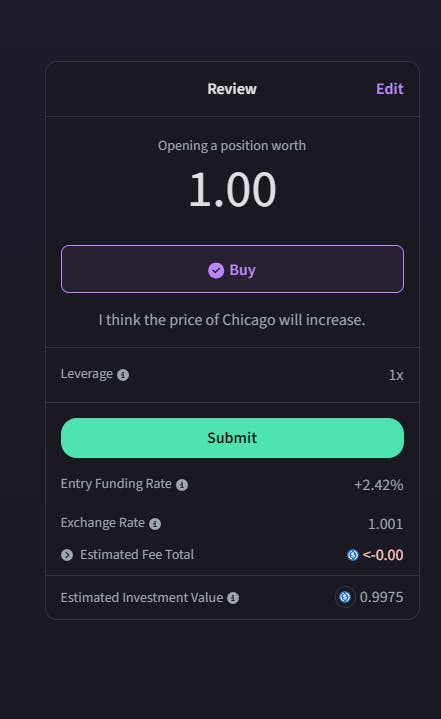

Look into the extra charges and the total amount by previewing it.

Click on Submit

After clicking on Submit the wallet will popup in requiring approval. Click on the approve button

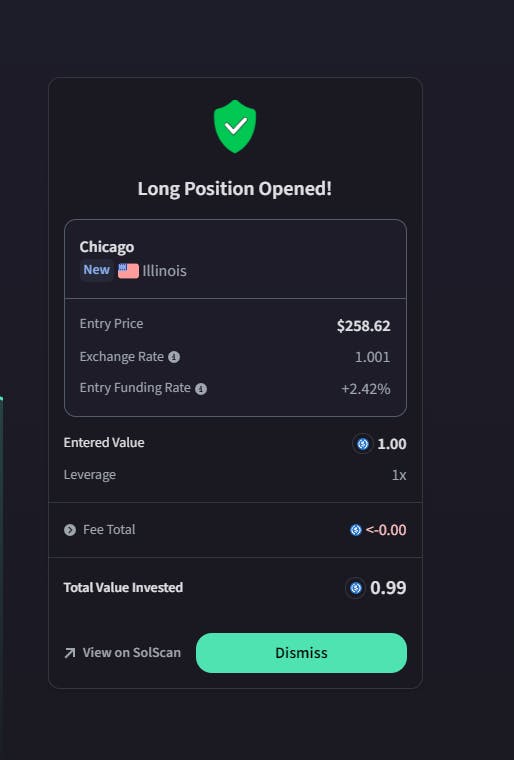

Once Approved you should see this screen

Where the position's card shows the following information on the left side:

Entry Priceis the price you opened the position at.Trade Directionis whether the position is long or short.Leverageis the position's price movement multiplier.The

Dateis the date and time when you opened the position.

Your position card shows the following information on the left side:

Position Valueis measured in liquidity tokens and then converted to USDC at the current exchange rate.Value is shown in the image next to the USDC logo. It is $.99.

Value is calculated as the sum of price movement since you opened the position and the accrued funding since you opened the position.

Your

Gainon the position is shown in green or red color.Gainis measured in USDC and also as a percentage.

Now you have successfully invested in the real estate of your choice

Now in order to exit , Click on open position to check the current open position of the current region

The close position will show the amount you would receive before submitting along with the profit or loss a percentage, click on preview and submit the page

Once done you would see the amount in your phantom wallet.

Congratulations you have completed the process of trading on Parcl , now don't stop hear and make some more better trades.

Reference:-

White paper of Parcl :- https://parcl.notion.site/Parcl-v2-6f27eaed8a5e46e29762a9de128ba0f9

Docs of Parcl :- https://docs.parcl.co/white-paper

Website of Parcl :- https://app.parcl.co/parcls/5387853